If you’ve seen headlines warning that today’s housing market looks like the bubble of 2008, you’re not alone. A viral post recently sparked conversations online, featuring a sign outside a new construction site promising “NEW HOMES ZERO DOWN”—echoing incentives many remember from the run-up to the last crash.

But while it’s tempting to draw comparisons, the reality in 2025 is quite different. Here’s what industry experts and market data reveal about where we stand today—and what it means for people buying or selling a home in the Bay Area.

Headlines vs Reality: What's Actually Happening?

Certain fast-growing regions, such as parts of Florida and Texas, are seeing more homes on the market and aggressive builder incentives, like mortgage rate buydowns and closing cost credits. This can feel familiar to anyone who remembers the lead-up to 2008, but there are critical differences shaping today’s market:

- Supply and Demand Are Fundamentally Different: In 2008, the market was flooded with too many homes and risky loans. In 2025, much of the country, including Silicon Valley, faces a continued housing shortage that keeps prices steady—even with slower buyer activity.

- Lending Today Is Much Stricter: Most buyers now go through rigorous qualification, thanks to tighter lending standards established after the last crisis. Subprime loans, which were common in the 2000s, are rare today—helping reduce financial risk for both buyers and lenders.

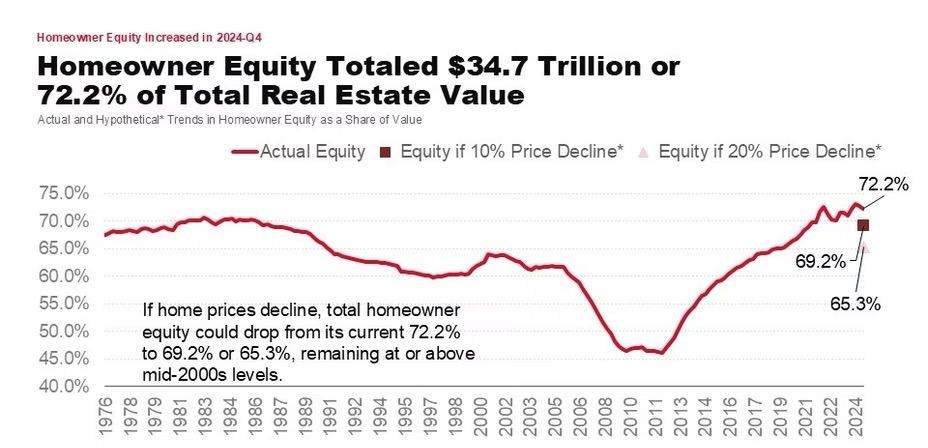

- Homeowner Equity Is Stronger: Even if home prices dipped, most homeowners today have far more equity than before 2008. This gives sellers more options and helps prevent the wave of foreclosures that followed the previous downturn.

Builder Incentives: What Do They Mean For You?

Builders are getting creative to move unsold inventory, offering substantial perks—sometimes contributing to mortgage buydowns, covering closing costs, or adding upgrades. However, these incentives are more about adapting to local buyer hesitation than signaling a national crisis. For homebuyers, it’s wise to look beyond the “deal” and focus on total costs and long-term value.

Lessons From 2008 Still Apply

Even in a changed landscape, some rules are timeless:

- Know What You Can Comfortably Afford: It’s as important as ever to stick within your real budget—not just what a lender approves. Don’t stretch in hopes of catching quick appreciation. Aim for a mortgage that fits your life, with room to spare if costs shift.

- Build an Emergency Buffer: Unplanned expenses can happen, so keeping several months of living costs set aside is crucial. This can help you weather any storms, whether market-related or personal.

- Choose the Right Loan Product: Fixed-rate loans offer stability and peace of mind when rates are volatile, while adjustable-rate loans can introduce risk if your financial situation changes down the line.