Why Everyone's Talking About Rates Right Now?

If you’ve been sitting on the sidelines waiting for mortgage rates to dip, you’re not alone. For much of 2024 and 2025, buyers and sellers alike have been hoping for a return to the low-rate environment of the early 2020s.

But what if those rate cuts never come?

As we head toward 2026, there’s growing consensus that

rates may remain elevated longer than expected—hovering between

6.25% and 7%

well into the next year. Whether you’re buying, selling, or refinancing, understanding what this means for the housing market is essential.

What Happens If Rates Stay High?

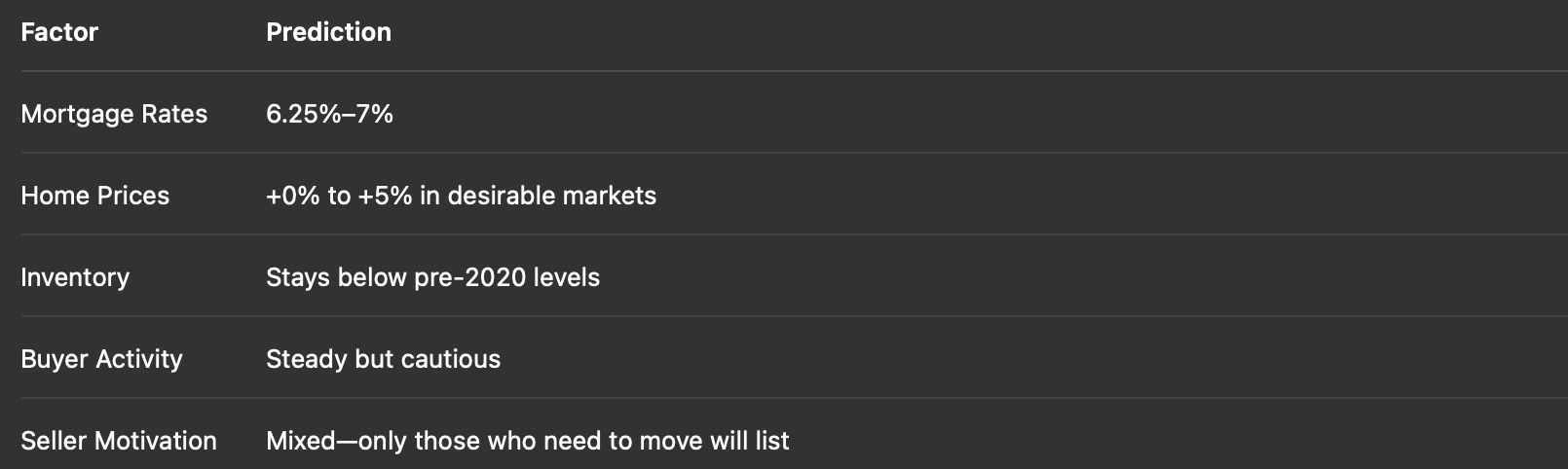

Here’s what we can expect if rates don’t drop significantly in the next 12 months:

A) Inventory May Stay Low:

- Many current homeowners are locked into sub-4% mortgages.

- If rates remain high, they’ll be less inclined to sell, further tightening housing supply.

Translation: Expect continued low inventory, especially for entry-level and move-in-ready homes.

B) Home Prices May Stay Flat or Rise slowly:

- Without a drop in rates, demand may cool slightly—but so will new listings.

- Tight inventory could keep prices stable or lead to modest gains, particularly in desirable markets like Silicon Valley.

Prediction: Areas like Saratoga, Cupertino, and Los Gatos could still see 2–5% appreciation.

C) Affordability Stays a Challenge

- Higher rates = higher monthly payments.

- This affects first-time buyers the most, especially in high-cost regions like the Bay Area.

Tip: Buyers may need to adjust price expectations or explore creative financing options like buydowns or ARMs.

D) Sellers May Need to Adjust Strategy

- If rates stay high, buyers will be more selective.

- Sellers will need to price homes competitively and invest in prep (staging, small upgrades, marketing) to attract serious offers.

Homes that are overpriced or need major updates may sit longer than usual.

E) Buyers Who Act Now Could Win Later

- If rates stay high now but drop in late 2026 or 2027, early buyers could refinance and build equity in the meantime.

- Waiting for perfect conditions may mean missing out on current inventory and price points.

“Date the rate, marry the house” may still apply.

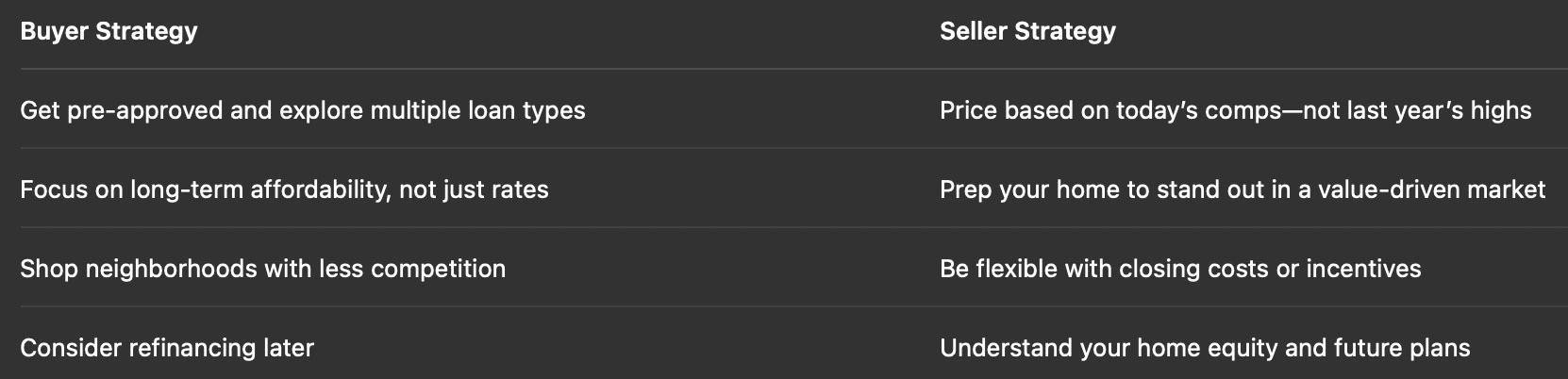

What Buyers and Sellers Should Do:

Even with market shifts, buyer demand is outpacing supply in many Bay Area neighborhoods.

If homes like yours are selling within 2–3 weeks and inventory is tight, you may be in a strong position to command top dollar with less competition—especially if your home is move-in ready or located in a top school district.

Quick Forecast: Real Estate Without a Rate Drop

FAQs

A) What's Causing Rates to Stay High?

- Lingering inflation, tight labor markets, and cautious Fed policy are all factors. The Fed has signaled it won’t rush rate cuts unless inflation drops meaningfully.

B) Will Waiting Make it Cheaper to Buy?

- Not always. Even if rates fall later, home prices and competition may rise, offsetting the savings.

C) Should I Buy Now or Wait?

- If you’re financially ready and plan to stay 5+ years, buying now may make more sense than waiting for a “perfect” rate.

Bottom Line: Plan, Don't Pause

Rates may not drop dramatically but the market will keep moving. The key is to make a plan based on your personal goals, not predictions.

👉 Contact me to discuss your options