At some point in every homeowner’s journey, the question eventually comes up: Is it time to renovate—or is it better to move?

Maybe your family has grown, you’re working from home full-time, your storage is maxed out, or the layout that once worked simply doesn’t fit your lifestyle anymore.

HGTV’s Love It or List It makes the decision look simple, but real-life choices are far more complex—especially with today’s higher interest rates and elevated home prices. This guide breaks down the key factors you should consider before choosing to renovate or move.

-When Staying and Renovating Makes Sense-

Renovation can be the right choice, but only if certain conditions line up. Michael Winn, founder and CEO of Winn Design + Build in McLean, Virginia, shares several factors he advises homeowners to evaluate.

1. You Love Your Lot or Neighborhood

Location is one of the biggest reasons people decide to renovate instead of move.

If you’re attached to the

schools, walkability, local amenities, neighbors, or the charm of your home, staying put may be the better option. Some things—like community feel or character—are difficult to replicate elsewhere.

2. Your Property Can Support The Renovation You Want

Before moving ahead, consult an architect to understand what’s actually possible:

- Can the existing structure support the changes?

- Is the lot large enough for an addition?

- What are the zoning or permitting limitations?

As Winn notes, “Sometimes it’s more cost-effective to buy or build new rather than retrofit."

3.You Have a Low Mortgage Rate or Significant Equity

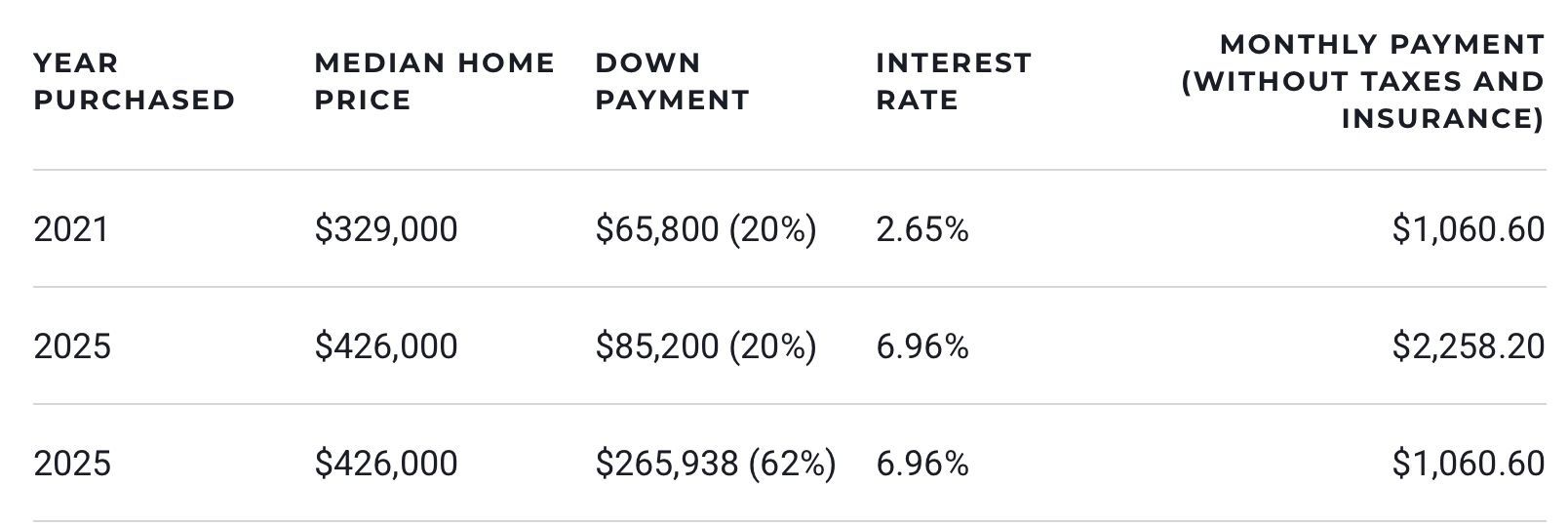

Homeowners who purchased between 2020 and 2021 may be holding exceptionally low mortgage rates, sometimes as low as 2.65%.

With today’s rates hovering near 6.9%, keeping that low payment can be a powerful incentive to stay.

For example:

If you purchased a median-priced home in 2021:

Mortgage loan: $263,200

Monthly payment: $1,060.60 (excluding taxes/insurance)

Buying a median-priced home today:

Same 20% down payment

Monthly payment at 6.96% interest: $2,258.20

That’s a 113% increase.

With a large amount of equity, you may be able to buy down your rate on a new purchase—but for many homeowners, replicating that low payment just isn’t feasible.

4. You Have the Time and the Budget for a Renovation

Renovations—especially major ones—can cost anywhere from $50,000 to $250,000+. A typical project may require:

- Architect fees

- Permits

- A general contractor

- Design selections

- Temporary relocation, depending on the scope

Most homeowners use a HELOC to fund a remodel, while others pay out of pocket. Compare the cost of your project to what you’d pay for a new home to ensure the renovation doesn’t stretch your budget more.

-When Moving Is The Better Choice-

Renovating isn’t always feasible—or practical. Often, moving solves more problems than remodeling ever could.

1. Your Property Can't Support The Renovations You Want

- Some homes simply weren’t designed for major additions or reconfigurations.

- If the lot size or structure limits your options, it may be time to look elsewhere.

2. It's More Cost-Effective to Buy Than Renovate

Depending on your market, acquiring a home that already has the space or features you need may cost less than remodeling your current one.

Real estate agent Mike Toltzis notes that once a renovation budget reaches $100,000–$150,000, many homeowners choose to move instead—avoiding the stress, time, and disruption of construction.

3. You Can Upgrade Your Lifestyle With a Move

To make moving worthwhile, your next home should be an improvement. Toltzis advises: “Don’t just move to move.”

A new property should offer:

- A better neighborhood

- More space

- A stronger long-term fit for your family

- Features that improve your everyday life

If you’ve built equity, you may also be able to reduce your monthly payment even with today’s higher rates.

Renovate vs Move: Factors To Consider

Financing & Affordability:

Higher home prices and interest rates will directly influence:

- Your budget

- Your future monthly payment

- Whether renovating or moving is the more cost-effective path

- Run the numbers carefully—and focus on what keeps your finances comfortable.

Market Conditions:

Market trends play a big role:

- In a slow market, renovating and waiting for better conditions may be smarter.

- In a competitive market, selling while demand is high could give you more purchasing power.

Look at comparable home sales to gauge how far your equity will take you.

Lifestyle and Stress Levels:

Both options come with disruptions:

- Moving means packing, cleaning, and coordinating logistics.

- Renovating means noise, dust, decisions, delays, and possibly temporary relocation.

For some families, the chaos of construction is more stressful than a move. For others, moving feels like too big of a shift.

The right choice depends on which process you can realistically manage.

Final Thoughts:

There’s no one-size-fits-all answer to the renovate or move question.

It comes down to:

- Your finances

- Your home’s potential

- Your neighborhood attachment

- Your long-term goals

- Your tolerance for construction or relocation

Take time to weigh the pros and cons—and consult with a trusted real estate professional, mortgage advisor, or architect to ensure you make the most informed decision possible.

Disclaimer:

This information is for educational purposes only and is not tax advice. Real estate transactions and tax laws are complex. You should consult with a qualified tax professional and a qualified intermediary to understand how these rules apply to your specific situation.