When it comes to estate planning, one question comes up often:

What’s the difference between a revocable living trust and an irrevocable trust?

Both are powerful tools—but they serve very different purposes. One offers flexibility, while the other provides protection. In this guide, we’ll break down the core differences between the two, especially as they relate to Medicaid planning, taxes, and preserving generational wealth.

Ownership: Who Controls the Assets?

A) Irrevocable Trusts:

Once you place your property into an Irrevocable Trust, it no longer legally belongs to you. The Trust becomes the owner of the asset. But that doesn’t mean you lose all access or benefits—you can still live in your home, drive your car, or earn income from trust-held assets. The key difference? You no longer personally own them, which makes them off-limits to creditors in most cases.

This level of separation offers strong asset protection—something Revocable Living Trusts (RLTs) cannot provide.

B) Revocable Living Trusts:

In an RLT, the grantor retains ownership and control. You can modify, revoke, or dissolve the trust at any time. While this flexibility is great, it also means the assets are still considered part of your estate and can be subject to creditors, taxes, and Medicaid lookbacks.

With a trust, ownership transfers quickly and privately, so your family can move forward without legal hurdles.

Can a Trust be Changed?

A) Irrevocable Trusts:

As the name suggests, these trusts are harder to modify or cancel. That’s exactly why they offer stronger legal and financial protection. However, depending on how it’s drafted, you can still update beneficiaries or provide instructions for managing assets—even while limiting your personal access.

B) Revocable Living Trusts:

RLTs are fully adjustable during your lifetime. You can change the terms, beneficiaries, and trustees at any time. But again, this flexibility comes with fewer protections.

Planning for a Long-Term Care and Medical Eligibility

A) Irrevocable Income - Only Trust (IIOT):

One of the most strategic uses of an Irrevocable Trust is for Medicaid asset protection. By transferring assets into the trust at least five years before applying for Medicaid, you can preserve your estate and avoid being forced to spend down your life savings to qualify.

This planning tool helps families avoid Medicaid clawbacks and protect an inheritance for future generations.

B) Revocable Trusts & Medicaid:

Assets in an RLT are still under your control—which means they’re counted when assessing Medicaid eligibility. Revocable trusts don’t shield assets from long-term care costs.

Who Can Be The Trustee?

A) Irrevocable Trusts:

Trustees are typically independent third parties, though they can also be a family member or someone close to you. The trustee manages the assets and must act in the best interest of the beneficiaries. The grantor cannot serve as trustee of an irrevocable trust if the goal is to protect assets from Medicaid or creditors.

B) Revocable Trusts:

In most RLTs, you are your own trustee—with full control over every asset in the trust. You also name a successor trustee to take over if you become incapacitated or pass away.

Tax Implications

A) Irrevocable Trusts:

These trusts have their own Tax ID number (EIN) and file a separate tax return (Form 1041). Depending on how the trust is structured, income may pass through to the grantor or beneficiaries via a Schedule K-1.

Importantly,

trust assets are not included in your taxable estate upon death, which may help reduce estate tax exposure.

This flexibility allows your real estate to continue working for your family—not just you.

B) Revocable Living Trusts:

RLTs are disregarded entities for tax purposes. You’ll still use your personal Form 1040, and the assets are included in your taxable estate. The trust avoids probate—but not taxes.

Do You Want Asset Protection?

If your goal is to protect your estate from creditors, lawsuits, or Medicaid spend-down, an Irrevocable Trust is the better choice.

With a properly drafted Medicaid Asset Protection Trust, you can shield your home, retirement funds, and other assets from being used to pay for long-term care—while preserving them for your children or heirs.

Revocable trusts, while useful for avoiding probate, offer no protection from creditors or government recovery programs.

What about Income Tax Returns?

- Irrevocable Trusts: File a separate return (Form 1041) using the trust’s EIN.

- Revocable Trusts: Report income and deductions on your personal tax return (Form 1040).

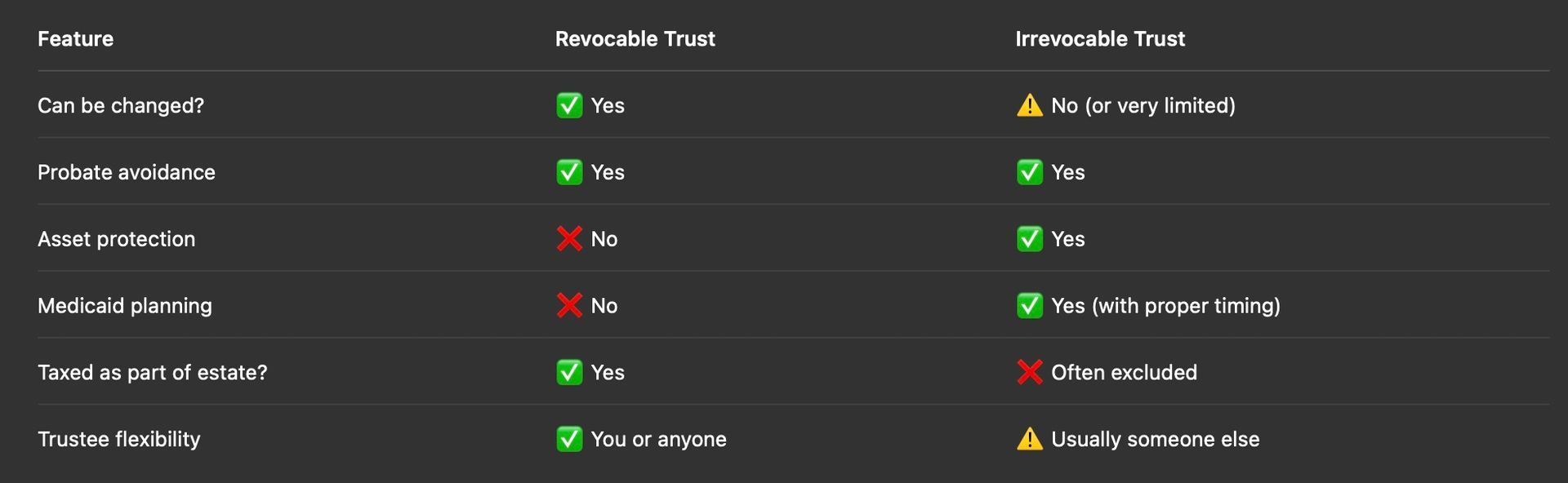

Quick Recap: Key Differences at a Glance

What About a Will? Isn't that Enough?

A Will only goes into effect after your death—and it must go through probate, which is public, time-consuming, and often expensive.

A Revocable Living Trust, on the other hand, goes into effect immediately and also helps plan for incapacity—something a Will can’t do. A trust allows your chosen trustee to step in if you’re unable to manage your affairs, without court involvement.

Final Thoughts: Which Trust Is Right For You?

- Choosing between a revocable and irrevocable trust depends on your goals.

- If you’re looking to avoid probate and keep control, a Revocable Living Trust may be the right fit.

- If you’re focused on

asset protection, Medicaid eligibility, and preserving wealth, an

Irrevocable Trust can offer the long-term security your estate plan needs.

- Either way, the key is planning early and intentionally. The right trust structure can make all the difference for you and the generations that follow.

Disclaimer:

This information is for educational purposes only and is not tax advice. Real estate transactions and tax laws are complex. You should consult with a qualified tax professional and a qualified intermediary to understand how these rules apply to your specific situation.