After several years defined by elevated mortgage rates and buyer hesitation, subtle but meaningful momentum is starting to build in the housing market. Sellers are becoming more active. Buyers are slowly returning. And for the first time in a while, the market is showing signs of forward movement.

This isn’t a sudden rebound — but it is a noticeable shift. And it could lay the groundwork for a stronger, more balanced housing market in 2026.

So what’s behind this change? Three key trends are helping bring new energy back into the market.

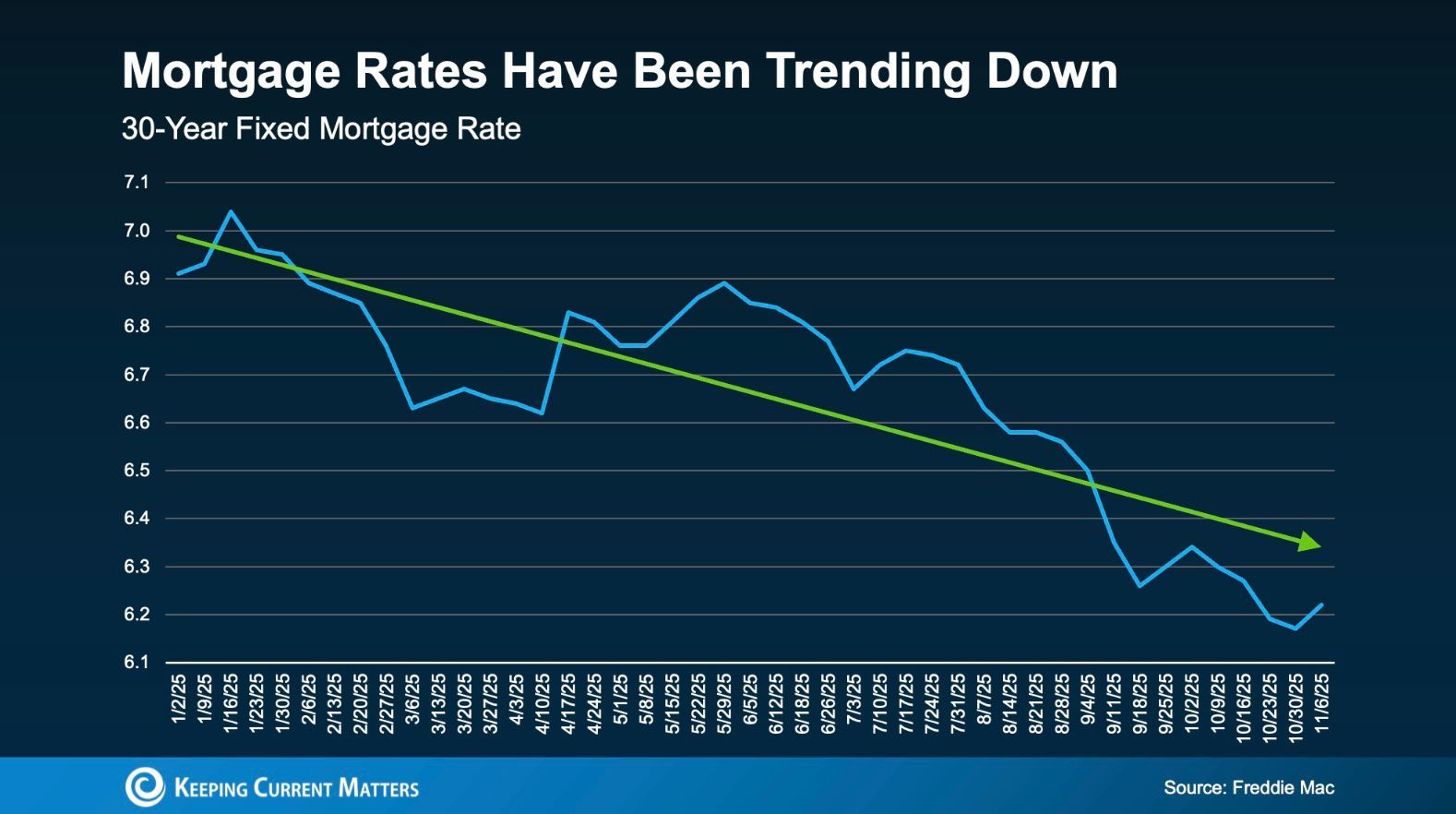

Mortgage Rates Are Trending Lower

Mortgage rates naturally fluctuate, especially during periods of economic uncertainty. Short-term volatility is expected — but what matters most is the broader direction.

Over the course of this year, rates have generally moved downward, with some of the most favorable levels seen in recent months.

According to Freddie Mac Chief Economist Sam Khater:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

Why does this matter? Lower rates directly affect buying power. Reduced borrowing costs allow buyers to qualify for higher-priced homes without increasing their monthly payment.

For example, Redfin data shows that a buyer with a $3,000 monthly housing budget can now afford approximately $25,000 more in home value compared to one year ago. That additional purchasing power is a meaningful driver of renewed activity.

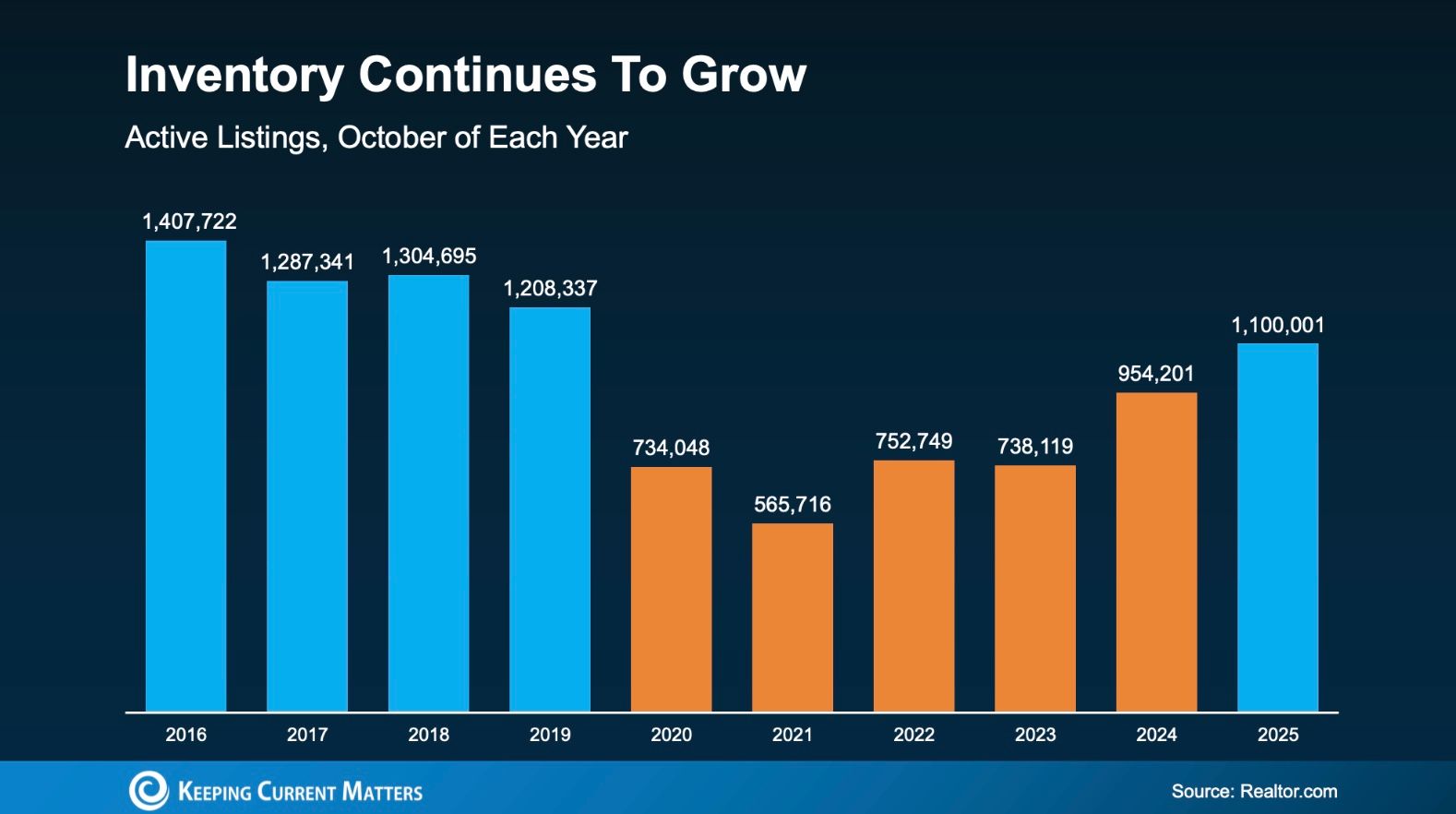

More Homeowners Are Willing To Sell

For much of the past few years, many homeowners chose to stay put rather than give up historically low mortgage rates. This “lock-in effect” limited inventory and kept supply tight.

While that effect hasn’t disappeared entirely, it is beginning to ease. As rates slowly decline and life circumstances change — such as growing families, job relocations, or lifestyle needs — more homeowners are deciding it’s time to make a move.

Realtor.com data shows a steady increase in the number of homes for sale, with inventory levels approaching ranges not seen in nearly six years.

This return toward more balanced inventory is a positive development. Buyers have more choices, and sellers are entering a market that feels healthier and more functional than it has in some time.

Buyers Are Gradually Re-Entering The Market

Sellers aren’t the only ones adjusting their outlook. Improved affordability and increased inventory are drawing buyers back as well.

The Mortgage Bankers Association reports that purchase applications are up compared to last year — a clear indicator that buyer interest is strengthening.

Looking ahead, several major industry groups — including Fannie Mae, the Mortgage Bankers Association, and the National Association of Realtors — are forecasting modest but consistent growth in home sales moving into 2026.

This isn’t a rapid surge. Instead, it’s a steady, healthier pace of recovery — the kind that supports long-term market stability

Bottom Line:

After a prolonged period of slowdown, the housing market is showing early signs of renewed momentum. Gradually declining mortgage rates, expanding inventory, and increasing buyer activity all point to a market that is regaining balance and confidence.

If you’re thinking about buying, selling, or simply want to understand how these shifts could affect your plans in 2026, now is a great time to start the conversation.

Reach out to learn more about what’s changing — and how to position yourself for what’s ahead.

Disclaimer:

This information is for educational purposes only and is not tax advice. Real estate transactions and tax laws are complex. You should consult with a qualified tax professional and a qualified intermediary to understand how these rules apply to your specific situation.